The purpose of LMW is to give Customs duty exemption to all raw materials components and machinery and equipment used directly in the manufacturing process of approved produce from the first stage of. Duty drawback is a process in which an entity in the US subject to the tariff can apply to recoup the duty paid if the product is subsequently exported in its original form without any value-added processes performed to it.

India Reduces Cpo Import Tariff Domestic Indian Price Rise But Cpo Futures Fall Sharply

Products that are not manufactured in the EU eg.

. It varies for different commodities from 5 to 40. Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods including animals transports personal effects and hazardous items into and out of a country. Licensed Manufacturing Warehouse LMW is a warehouse license under the provision of section 6565A of the Customs Act 1967 Malaysia.

And there was an import duty of 385 per cent on crude mustard oil and 45 per cent on refined. Agreement establishing the ASEAN-Australia-New Zealand Free Trade Area. This site is best viewed with Internet Explorer 50 and above with 1024 x 768 pixels resolution.

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Traditionally customs has been considered as the fiscal subject that charges customs duties ie. The duty rates have already been mentioned in the First Schedule of the Customs Tariff Act 1975 and are amended from time to time under the Finance Act.

Several cases of Anti-Dumping duty have been filed on the basis of our database. Country of Origin is optional for preferential duty or Antidumping duty Disclaimernull icegatehelpdeskicegategovin. Commercial value 03464 not less than 272 and more than 52833 HMF Fee.

The import duty rates vary between different products. Cybex Exim Solutions a market research venture with its expertise in data mining and data processing was conceived with the aim of eliminating the information gap that has long hampered the Indian. Quotas are used in.

After getting the current duty rates its time to calculate the import duty and total import tax which mainly consists of the following parts. TRQ is a quota for a volume of imports that will enter India at specified or nil duty but after the quota is reached the normal tariff applies to additional imports. On the other hand the opposite is often true for products that are considered part of an important industry in the EU.

A quota is a government-imposed trade restriction that limits the number or monetary value of goods that can be imported or exported during a particular time period. Commercial value 0125. BN Cambodia KH Indonesia ID Laos LA Malaysia MY Myanmar MM New Zealand NZ Philippines PH Singapore SG Thailand TH Vietnam VN.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Basic Duty is a type of duty which is imposed under the Customs Act 1962. Cybex Exim Solutions Gateway to foreign trade information.

Customs value customs duty rate imported quantity customs duty rate. Among them some anti-cancer drugs medical products aquatic products sports equipment oil paintings and antique artwork high-efficiency auto parts. Find Product-wise Indias TariffPreferential tariffGST Rules of Origin SPS-TBT measures.

Find Product-wise Export-Import Policy of India. Provide Tariff head andor Description andor Country of Origin. We are still in the process of gathering all the pertinent information from our suppliers and government agencies to review how duty.

The words tariff duty and customs can be used interchangeably. Tariffs and other taxes on import and export. Working tariff schedule AANZFTA.

In a notification issued on Tuesday the Finance Ministry prescribed a tariff rate quota TRQ under which an import of a quantity of 20 lakh tonnes lt each of crude soyabean oil and crude. Australia has other preferential arrangements that provide preferential rates. 24 May 2022 1053 PM IST Debate over tariffs reveals Joe Bidens difficulties on China trade.

Consumer electronics tend to have lower import duty rates sometimes as low as 0. Comprehensive Economic Cooperation Agreement between India and Malaysia CECA Preferential Trade Agreement Between India And MERCOSUR PTA. Tariff schedule of malaysia Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Starting January 1 2022 China will adopt provisional duty rates on a total of 954 imported commodities that were subject to the default MFN duties the provisional duty rates are lower than the MFN tariffs. The CM said those tariffs were an impediment to imports and that the import tariff on castor oil. Tariff also called customs duty tax levied upon goods as they cross national boundaries usually by the government of the importing country.

Trying to get tariff data. Tariffs may be levied either to raise revenue or to protect domestic industries but a tariff designed primarily to raise revenue also may exercise a strong protective influence.

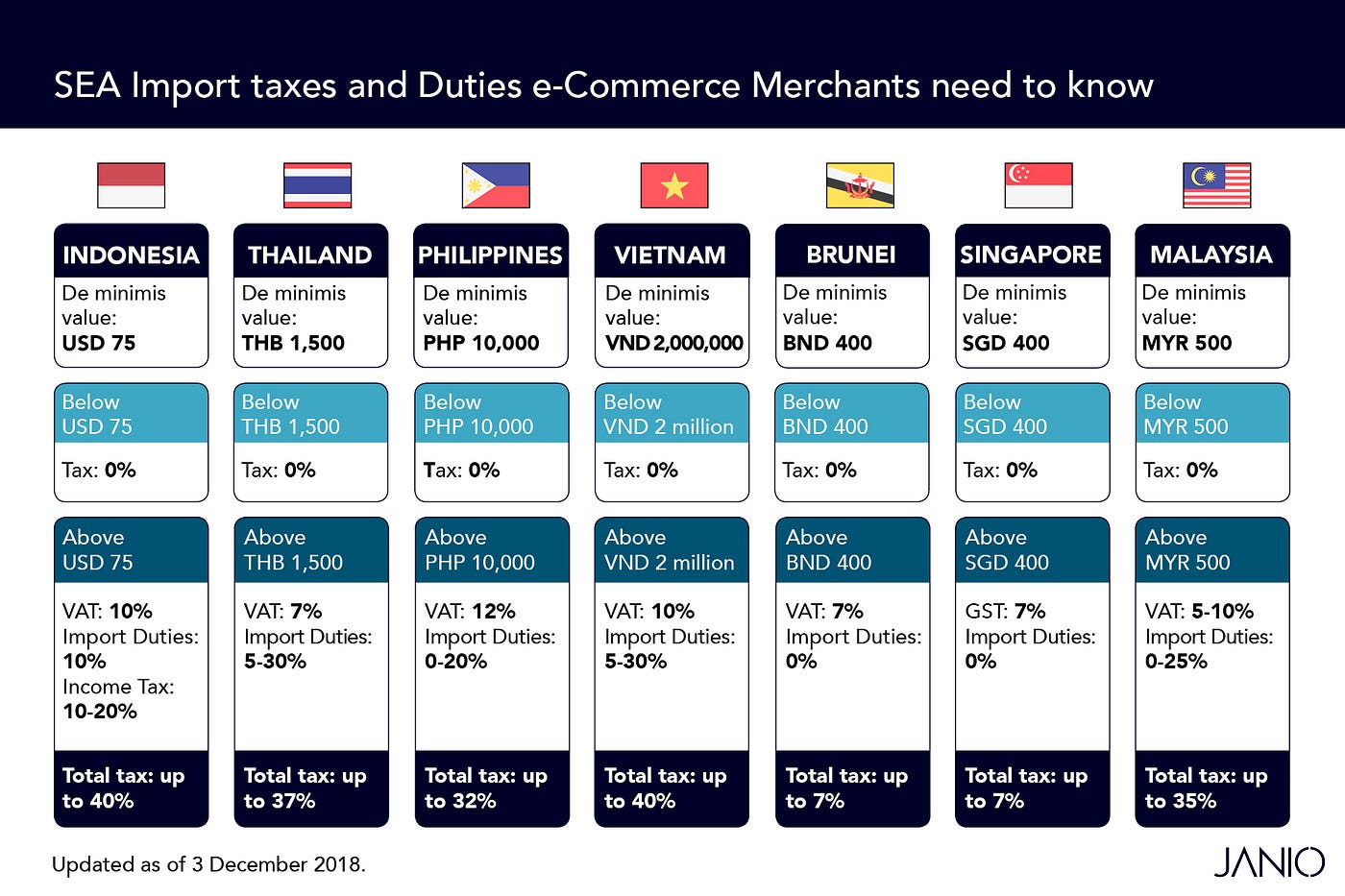

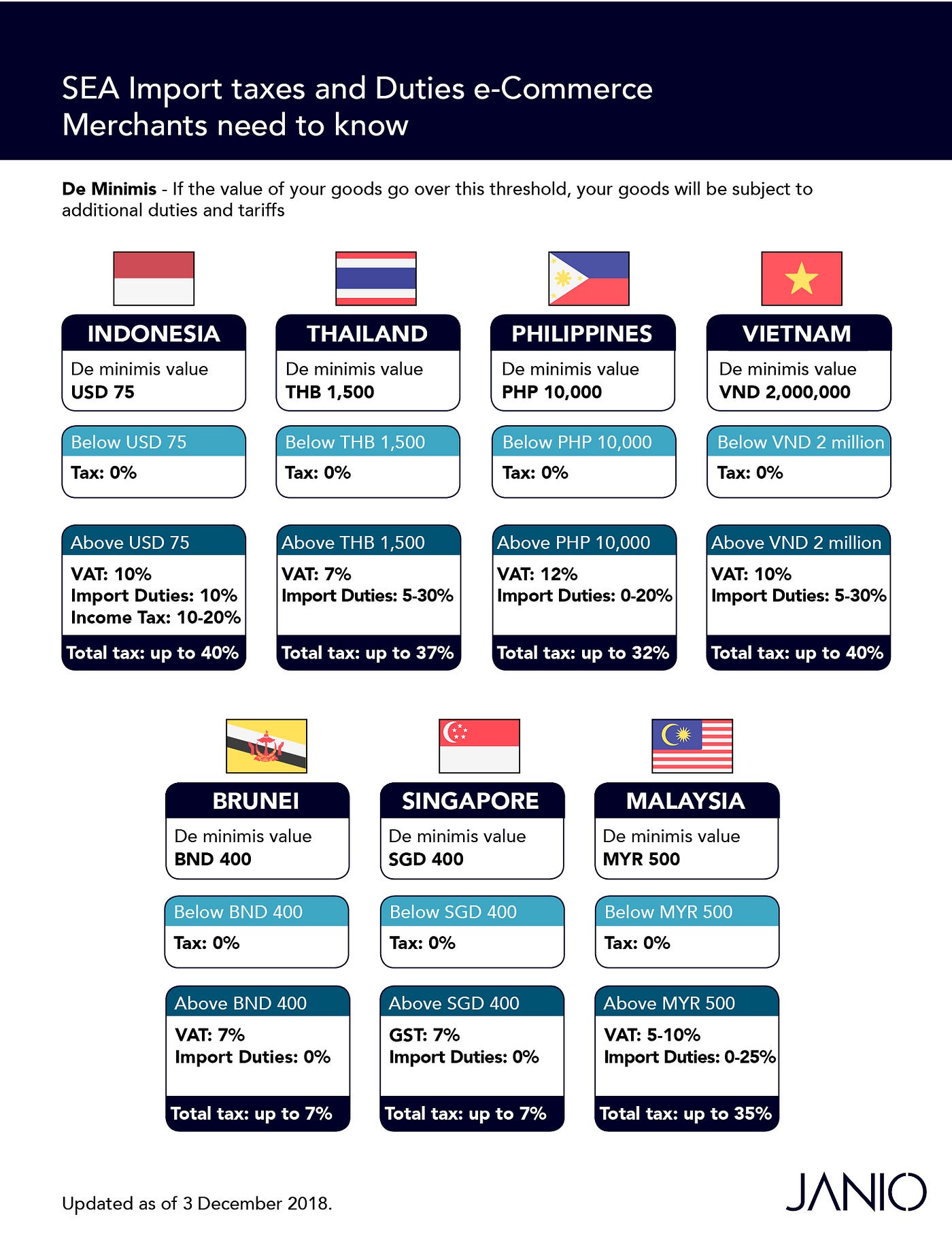

De Minimis Rate In Malaysia Janio

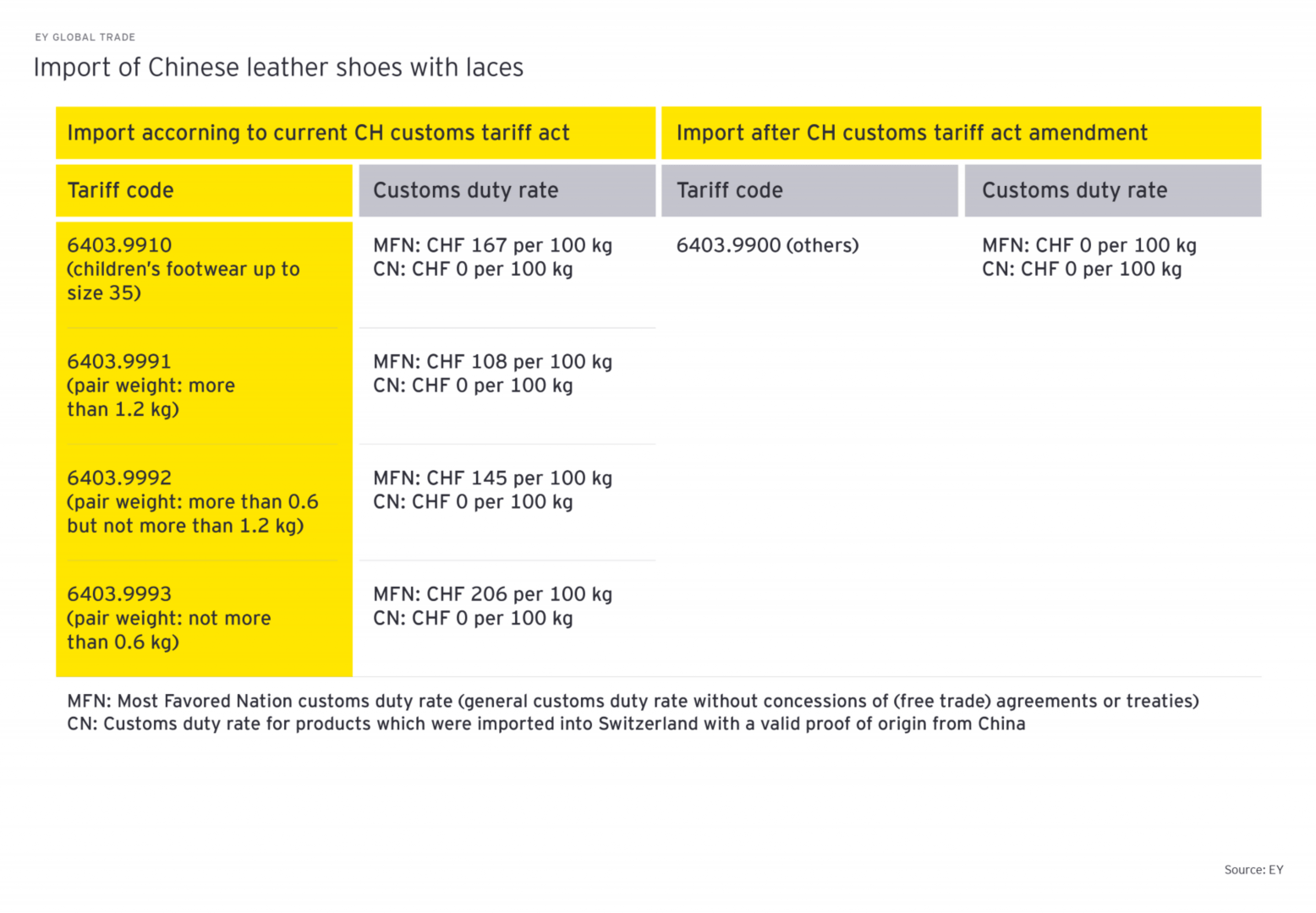

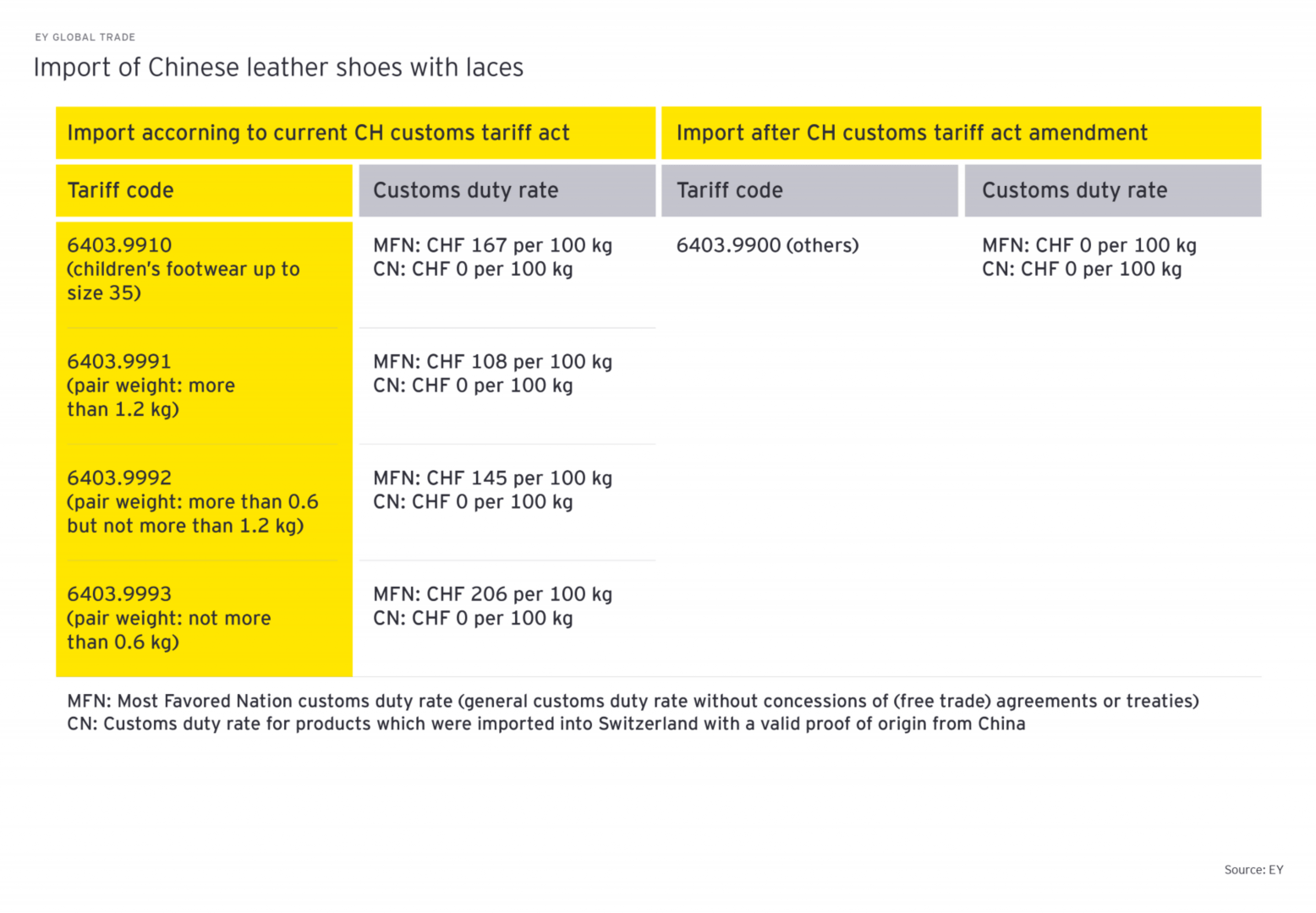

Import Duties On Industrial Products To Be Abolished In Switzerland Ey Switzerland

How To Calculate Uk Import Duty And Taxes Simplyduty

Customs Duties Services Services Indirect Tax Deloitte Japan Tohmatsu Customs Duty Customs Duty Reduction Customs Valuation Tariff Classification Customs Audit Fta Epa Trade Control Supply Chain

Tariffs And Ad Valorem Equivalent Of Ntbs By Gtap Sector Download Table

Asia The Import Duty Rate Other Taxes In Your Country When Purchasing Ceramic Sanitary Ware From China Professional Sanitary Ware Manufacturer From China Sunrex

Hs 2022 A New Edition Of The Harmonized System Is Coming

![]()

New Chinese Polysilicon Duties Are Slap In The Face To Trade Deal

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium

What Is The Difference Between Taxes Duties And Tariffs Trg

Tariffs And Ad Valorem Equivalent Of Ntbs By Gtap Sector Download Table

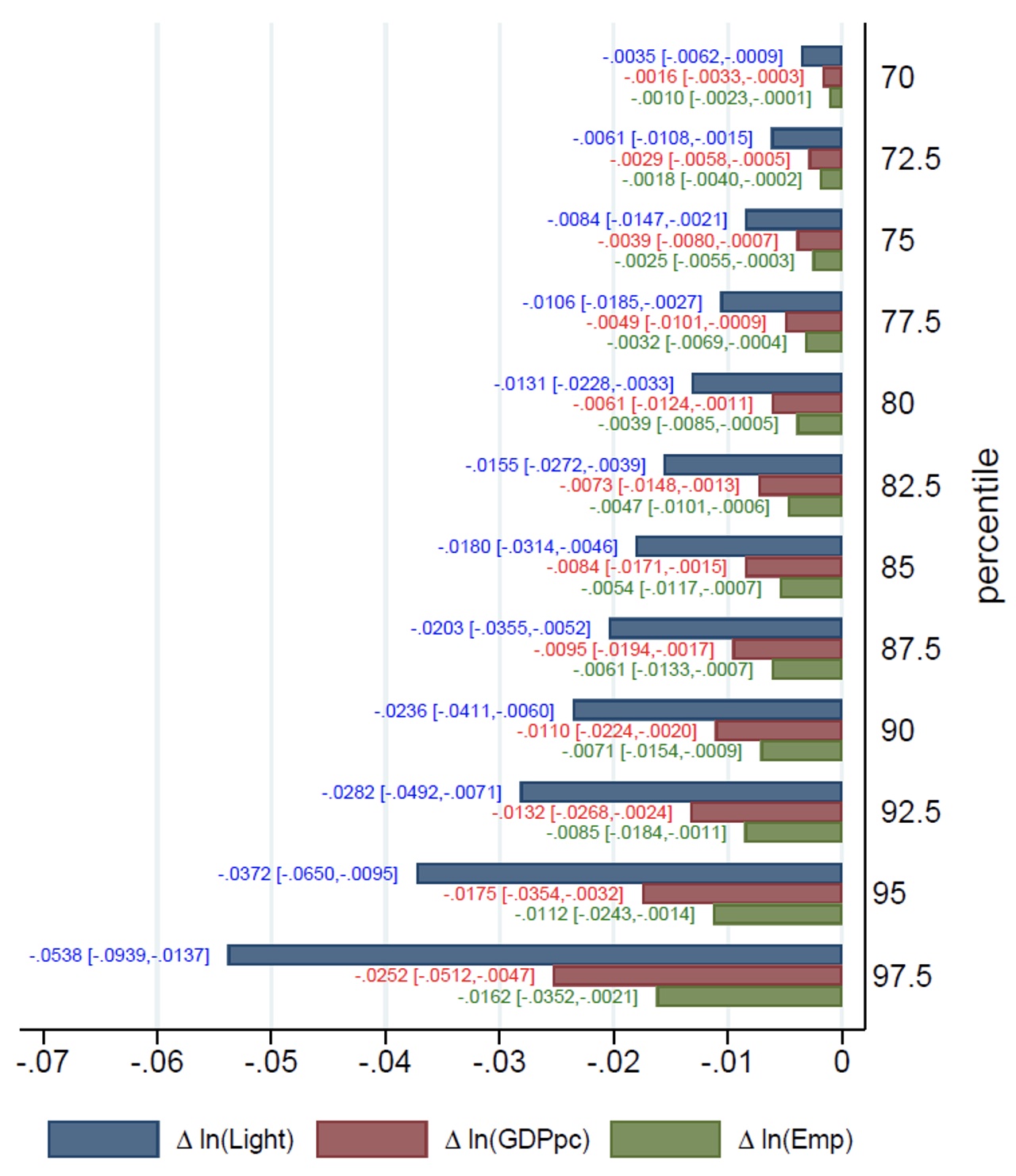

The Us China Tariff War And China S Economy Evidence From Night Lights Vox Cepr Policy Portal

![]()

The Ultimate Guide To Import Custom Duty Icontainers

Tariffs And Trade World Trade Organization

Import Duties On Non Eu Bicycles

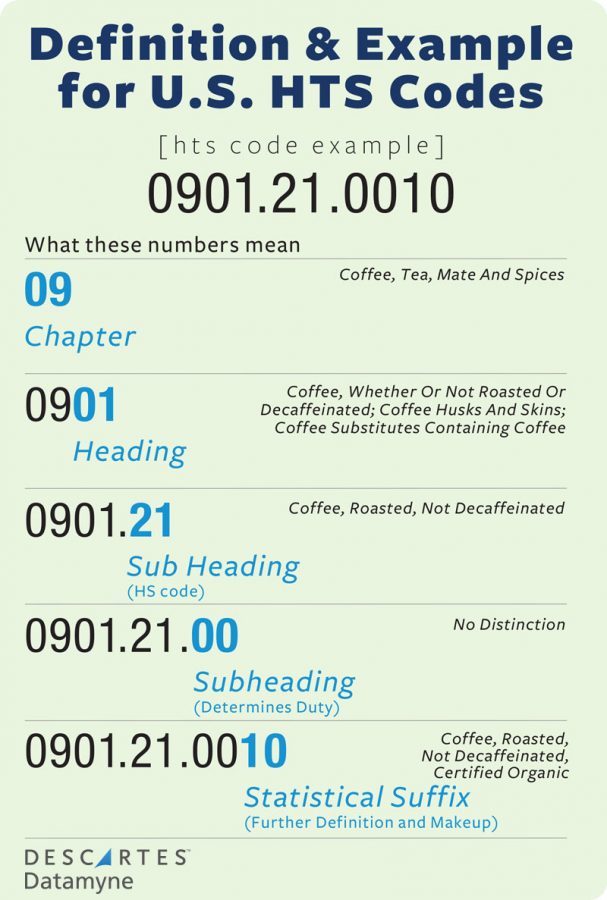

Hts Codes Complete Guide To International Imports 2022